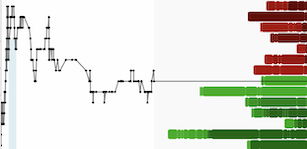

Caribbean Utilities Company, Ltd. is listed for trading in United States dollars on the Toronto Stock Exchange under the trading symbol "CUP.U".

GRAND CAYMAN, Cayman Islands , Nov. 5, 2024 /CNW/ - Caribbean Utilities Company, Ltd. (TSX: CUP.U) ("CUC" or the "Company") has announced its consolidated unaudited results for the three and nine months ended September 30, 2024, (all figures stated in United States Dollars).

Highlights for the period were as follows:

- Net Earnings for the three months ended September 30, 2024 ("Third Quarter 2024" or "Q3 2024") totaled $14.4 million, a 4% increase compared to the three months ended September 30, 2023 ("Third Quarter 2023" or "Q3 2023")

- 2% increase in kilowatt-hour ("kWh") sales when compared to Q3 2023 and a 2% increase in total number of customers when compared to Q3 2023.

- Capital expenditures of $72.8 million for the nine months ended September 30, 2024.

- In its commitment to reduce carbon emissions and maintain environmental stewardship, two of the five generating units slated for a life cycle upgrade have been completed, with work on the third progressing well. These upgrades will significantly enhance the engines' fuel efficiency and reduce CO2 emissions. The upgrades will also allow for the transition to liquefied natural gas in the future.

- The Company commissioned its first battery energy storage facility ("BESS"). This system will allow for increased renewable energy capacity in Grand Cayman. The 20-megawatt ("MW") BESS is anticipated to lower fuel costs and improve fuel efficiency by 5% to 6%, leading to a corresponding reduction in CO2 emissions.

- Ongoing infrastructure hardening demonstrated resilience during the summer months with two significant weather events affecting the region with minimal customer disruption.

"The Company continues to focus on capital investment and infrastructure projects with an emphasis on sustainability. The investment in resiliency projects proved prudent during recent weather events this quarter, leading to fewer outages for customers when Grand Cayman was affected by the weather. CUC is focused on cost-effective, environmentally positive investments that are beneficial for our customers." said Mr. Richard Hew, President and Chief Executive Officer.

Capital Expenditures

Capital expenditures for the nine months ending September 30, 2024, were $72.8 million. These expenditures covered projects such as distribution system extensions and upgrades, generation replacements, lifecycle upgrades, installation of battery energy storage systems, and upgrades to the Frank Sound Substation.

Net Earnings and Sales Revenues

Net earnings for Q3 2024 were $14.4 million, a $0.5 million increase when compared to net earnings of $13.9 million for Q3 2023. This increase is primarily attributable to higher income from pipeline operations and lower finance charges. After adjusting for dividends on the preference shares of the Company, earnings on Class A Ordinary Shares for Q3 2024 were $14.3 million, or $0.38 per share, compared to $13.8 million, or $0.36 per share for Q3 2023.

On a year-to-date basis, net earnings were $30.7 million, a $1.6 million increase from net earnings of $29.1 million for Q3 2023. The increase was due to higher other income and lower finance charges. After the adjustment for dividends on the preference shares of the Company, earnings on Class A Ordinary Shares for Q3 2024 were $30.4 million, or $0.80 per Class A Ordinary Share, as compared to $28.8 million, or $0.76 per Class A Ordinary Share, for Q3 2023.

Sales in kWh for Q3 2024 were 208.0 million kWh, a 2% increase (4.8 million kWh) from Q3 2023 and bringing the year-to-date sales growth to 4%. This increase was driven by a 2% growth in customer numbers and an increase in the average kWh consumption of residential customers. The average temperature for Q3 2024 was 87.0 degrees Fahrenheit, comparable to 87.2 degrees Fahrenheit in Q3 2023.

Fuel factor and renewable energy costs are passed through to customers without any markup. The Fuel Factor consists of charges from diesel fuel and lubricating oil costs, which are passed through to consumers on a two-month lag basis. The average Fuel Cost Charge rate for Q3 2024 was $0.23 per kWh, compared to $0.21 per kWh in Q3 2023.

Resiliency

During the summer months, the Cayman Islands experienced two significant weather events. The ongoing investments in infrastructure hardening demonstrated resilience as power outages impacted less than 10% of customers during the passing of Hurricane Beryl and only 300 customers were without power during Tropical Storm Helene. All customers were restored in less than 48 hours.

Award-Winning Green Financing Framework

In April 2024, the Company created its Green Financing Framework which was assessed by Sustainable Fitch as "Excellent". In May 2024, the Company issued US$80 million of senior unsecured debt. In alignment with the Green Financing Framework, US$50 million of the net proceeds, have been dedicated to fund new and ongoing projects to enhance sustainability, including energy efficiency, climate change adaptation, and clean transportation in Grand Cayman. In October 2024, the Global Banking & Markets Latin America Awards recognized the May 2024 debt issuance as the "Caribbean Debt Deal of the Year". The Company's ability to structure borrowing in this way supports investment in infrastructure that will reduce costs and improve environmental performance for our customers and the community of Grand Cayman.

Community Commitment and Recognition

The Company continued with its commitment to community development through various partnerships and support programmes in Q3 2024. Monetary support was provided to multiple different organizations and charity groups throughout the quarter. The Company remains committed to the people and community of Grand Cayman. In Q3 2024, the Company also supported its Caribbean neighbour, Jamaica, post Hurricane Beryl by sending line crews to assist with post-restoration efforts.

Additional Information

CUC's Third Quarter 2024 results and related Management's Discussion and Analysis ("MD&A") are attached to this release and incorporated by reference. The MD&A section of this report contains a discussion of CUC's unaudited Third-Quarter 2024 results, the Cayman Islands economy, liquidity and capital resources, capital expenditures, and the business risks facing the Company. The release and the Third Quarter 2024 MD&A can be accessed at www.cuc-cayman.com (Investor Relations/Press Releases) and www.sedarplus.ca.

The principal activity of the Company is to generate, transmit and distribute electricity in its licence area of Grand Cayman, Cayman Islands, pursuant to a 20-year Transmission & Distribution ("T&D") Licence and a 25-year non-exclusive Generation Licence (the "Generation License" and together with the T&D Licence, the "Licences") granted by the Cayman Islands Government (the "Government", "CIG"). The T&D Licence, which expires in April 2028, contains provisions for an automatic 20-year renewal and the Company has reasonable expectation of renewal until April 2048. The Generation Licence expires in November 2039. Further information is available at www.cuc-cayman.com.

Caribbean Utilities Company, Ltd. ("CUC" or "the Company"), on occasion, includes forward-looking statements in its media releases, Canadian securities regulatory authorities filings, shareholder reports and other communications. Certain statements in the MD&A, other than statements of historical fact, are forward-looking statements concerning anticipated future events, results, circumstances, performance or expectations with respect to the Company and its operations, including its strategy and financial performance and condition. Forward looking statements include statements that are predictive in nature, depend upon future events or conditions, or include words such as "expects", "anticipates", "plan", "believes", "estimates", "intends", "targets", "projects", "forecasts", "schedule", or negative versions thereof and other similar expressions, or future or conditional verbs such as "may", "will", "should", "would" and "could". Forward looking statements are based on underlying assumptions and management's beliefs, estimates and opinions, and are subject to inherent risks and uncertainties surrounding future expectations generally that may cause actual results to vary from plans, targets and estimates. Some of the important risks and uncertainties that could affect forward looking statements are described in the MD&A in the section labeled "Business Risks" and include but are not limited to operational, general economic, market and business conditions, regulatory developments and weather. CUC cautions readers that actual results may vary significantly from those expected should certain risks or uncertainties materialize or should underlying assumptions prove incorrect. Forward-looking statements are provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise except as required by law.

SOURCE Caribbean Utilities Company, Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/05/c9848.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/05/c9848.html